Peter Winick has made it into the top 100 for Thought Leader Personal Branding at…

Want To Be Known as an Expert? Write a Book

Source: Want To Be Known as an Expert? Write a Book

Author: John Kador

Differentiation is a key marketing challenge faced by every financial advisor. No matter how special you think you are, to most clients, one advisor looks pretty much like any another. Why should any prospect, then, choose your products or services over someone else providing the same products and services and marketing themselves in the same way?

To a growing number of advisors, the answer to that question is to assert their authority and differentiate themselves by writing and publishing a book.

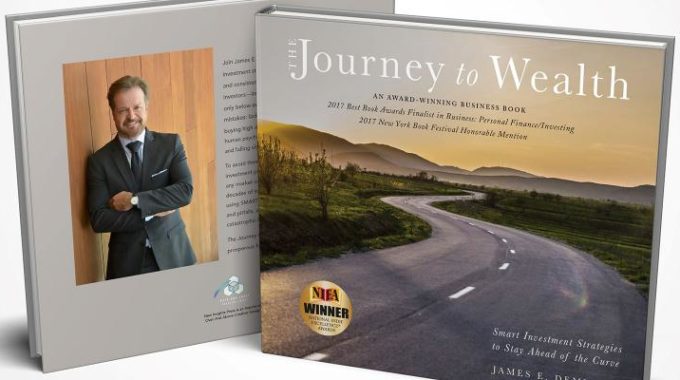

It’s a high hurdle to be sure, but the journey is worth it, says James Demmert, founder and managing partner of Sausalito, Calif.-based Main Street Research and author of The Journey to Wealth. “Let’s face it, to busy lawyers and trust attorneys, we all look alike,” Demmert concedes. “Now [with the book] when I meet with prospects, I’m the guy who wrote the book. That’s authority.”

Writing a book to promote one’s brand demonstrates the power of authority marketing.

Authority is a matter of perception and psychology. Society treats authors as, well, authoritative. We regard books as intrinsically valuable. (When was the last time you discarded a book?) Americans have literally created monuments to books—libraries.

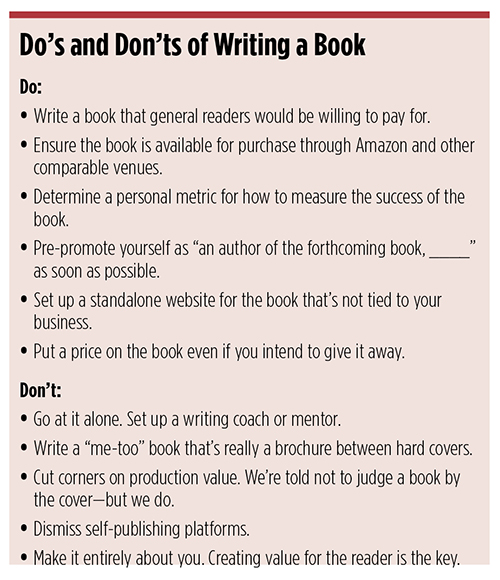

It’s important not to be too cynical, however. Publishing a book is a multi-year project. It’s simply not feasible for active advisors to complete a book unless the theme consistently energizes him. There are better ways of spending marketing dollars than in writing a generic book, which has little purpose other than as an expensive calling card.

Writing a book as part of an advisor’s positioning strategy is an investment in establishing an authoritative brand, says Peter Winick, president of Thought Leadership Leverage, a firm that assists would-be authors in writing books and creating revenue streams from their expertise. “As with any other investment, the important question is how advisors can measure the ROI of writing a book and how the investment can be amortized,” Winick says. The good news is that with books the investment can be amortized over five to 10 years, a much longer period than with other marketing outlays, such as seminars, golf outings or podcasts.

“Books are force multipliers,” says Harper Tucker, chair of the Finance Practice Group at ForbesBooks, a hybrid publisher. “The key goal of a book is to build trust with the advisor’s target audience,” he adds. The more specific advisors can be in defining their target audience, in both psychographic and geographic terms, the larger the book’s clout will be.

Demmert focused on the return of investment calculation by considering the lifetime value of a new client. While he invested upwards of $50,000 in out-of-pocket costs to produce his book, he has seen that sum returned many times over. In the last 18 months, of those prospects who were on the fence between Demmert’s firm and competitors, he got the nod 70 percent of the time, a feat that he attributes to the authority his lush coffee table book provided. For those who want to succeed, Demmert offers this advice:

“Don’t try to do it alone. Writing a book requires the concentration of a lot of uninterrupted time and focus over a period of a year or two, luxuries few active advisors have in abundance.” Happily, there’s an industry of editorial assistants, literary agents, ghostwriters and brand management agencies available to free up the advisor.

Also, writing a book can be a lonely task. One way to break the isolation is to join a writing group. The opportunity to share progress, discuss issues that all writers share and hold each other accountable for progress can make a big difference.

Once the book has been written, a seemingly endless stream of decisions begins. In what form will it be delivered? What production values do you want it to have? Hard cover? Soft cover? Color? Photographs or illustrations? Index? The more you spend, the more the resulting book looks and feels like those that readers find on the shelves of book stores. That’s the standard that most advisors pursue. Is the resulting book a product that a reader is willing to spend money on?

Once the book has been written, a seemingly endless stream of decisions begins. In what form will it be delivered? What production values do you want it to have? Hard cover? Soft cover? Color? Photographs or illustrations? Index? The more you spend, the more the resulting book looks and feels like those that readers find on the shelves of book stores. That’s the standard that most advisors pursue. Is the resulting book a product that a reader is willing to spend money on?

Most advisors elect to use a self-publishing service because it is so much faster and gives the advisor more editorial control than working with a traditional publisher. There are many turnkey publishing solutions that, for a fee, will edit the advisor’s content, design a cover, create an index, print it and handle a wide range of distribution options. Do you want your book to be available on Amazon or other online sellers and for order in bookstores? (The answer to this question must be yes, advisors say, or don’t bother.)

Even if you intend to give the book away for free, put a price tag on it anyway. A price tag of, say, $39.95 on the back cover signals the book’s value. People tend to regard products as premium when they come with premium price tags.

Finally, realize that marketing and promoting a book can be very time-consuming. At the minimum, the book needs a high-quality website that is independent of the advisor’s business. An independent website gives readers assurance that the author has an existence that is not connected to a commercial purpose. Compliance officers have fewer issues when there is clear daylight between the book and the practice.

A worthwhile guide to advisors considering to write a book is Lead the Field for Financial Professionals: Become an Authority and Dominate Your Competition, by Harper Tucker and Adam Witty. It explains the power of authority marketing—the strategic process of systematically positioning a person or organization as the leader and expert in the marketplace to command outsize influence over competitors.

Passion and Purpose

Because of the length of the writing and publishing process, passion for the subject matter is an essential element for an advisor looking to publish a book.

Passion for helping women gain control over their financial circumstances motivated Laura Mattia to write Gender on Wall Street: Uncovering Opportunities for Women in Financial Services. “I really want to start a conversation about financial competency,” Mattia says.

Mattia’s passion is leading her from a career as a CFP to a visiting faculty position at the University of South Florida, a step that she believes will give her a bigger platform to help women become better engaged in their financial lives. That’s another example of the power of a book. It can transform the way the world sees the author.

An example of an active advisor writing a book out of passion and purpose is Robb Baldwin, founder and CEO of the custodial/brokerage support service firm TradePMR in Gainesville, Fla. Baldwin is at the beginning of the author journey but doesn’t underestimate its cost or difficulty. He has budgeted up to $50,000 to the task and lined up a ghostwriter and a team of editorial mentors to support him.

Baldwin wants his work to be genuinely helpful to readers who are coming out of the broker-dealer and wirehouse world and want to understand the obligations and environment of the fee-only world they’re about to enter. He made this transition himself and understands how fraught it can be. Baldwin’s key metric for success is knowing his book made a difference. “A note from a reader said, ‘Hey, I read your book and it helped me negotiate my way’ is all the success I hope for,” Baldwin says.